Trusted by 10,000+ Florida families

REVERSE MORTGAGES IN FLORIDA

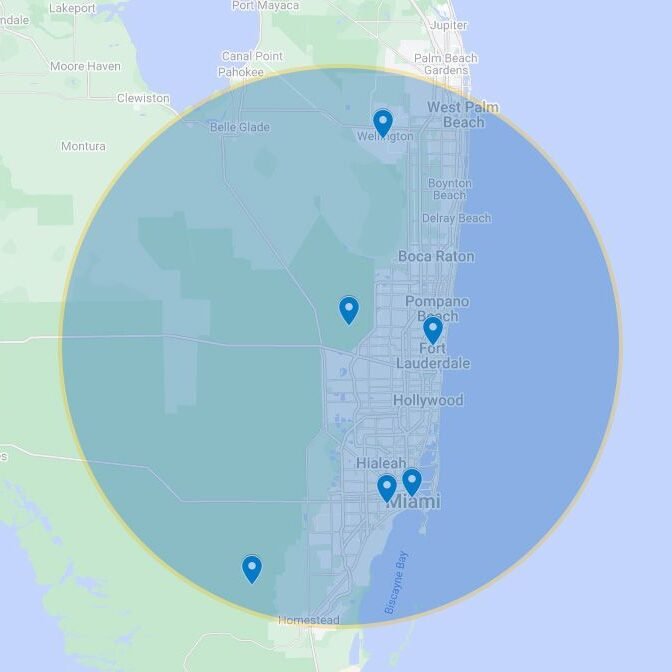

It is hard to anticipate everything that life throws at you until it happens. However, when you’re up against a wall, you need to know that you have options to help you get back on your feet. A reverse mortgage can be just the thing to help you when you need cash. When you need to understand how a reverse mortgage can serve you, Home Financing Center is here to help — we serve Coral Gables, Miami and beyond. Our lending experts have been in the business for over three decades — contact us today!

Advantages of a Reverse Mortgage

You still own your home

No monthly mortgage payments

Protected from housing market declines

You have options for disbursement

Whether you want to lower your interest rate, monthly payments, or loan term, a home financing firm like Home Financing Center, can help you.

Do A Reverse Mortgage Right With Us

As a significant financial strategy, a reverse mortgage must be done right. Otherwise, it can make a situation that much more difficult. Many people choose reverse mortgages because their lenders pay them instead of the other way around. Having cash that can be used on anything from vehicle purchases to retirement expenses can make a huge difference. The key is making sure the reverse mortgage will work for you. The Home Financing Center team has customized reverse mortgages to people for more than three decades, and we’ll bring every bit of our experience to the table for you.

Contact Our Lending Experts

Your financial future is important to us. We work hard to empower you with knowledge, options, and insights so that you can make your financial future all that it needs to be. Contact us in South Florida to get started today.

Our Commitment to You

At Home Financing Center, we understand the importance of providing excellent customer service. Our team of experts is available to answer any questions you may have and to help you navigate the home financing process. We are committed to providing you with the best possible mortgage experience and will work hard to get you the best possible rate and terms.

What Our Clients Say

4.9/5 from 1,200+ reviews

Don't just take our word for it - hear from satisfied homeowners across Florida.

Home Loan Frequently Asked Questions

Find answers to common questions about our services.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has an interest rate that remains the same throughout the life of the loan. An adjustable-rate mortgage (ARM) has an interest rate that can change over time, usually in response to interest rate fluctuations in the market.

What factors determine the interest rate on a home mortgage?

The interest rate on a home mortgage is determined by several factors, including the loan-to-value ratio, the borrower’s credit score, the loan term, and the type of loan.

How much money do I need for a down payment?

The amount of money you need for a down payment depends on the type of loan you are getting and the lender’s requirements. Generally, you should expect to put down at least 3–5% of the purchase price of the home.

What are closing costs?

Closing costs are fees associated with the purchase of a home that are paid at closing. These fees can include loan origination fees, appraisal fees, title fees, and more.

What documents are required when applying for a home mortgage?

When applying for a home mortgage, you will typically need to provide the lender with your financial information and documents, such as pay stubs, bank statements, and tax returns. You may also need to provide proof of employment and proof of assets.