Trusted by 10,000+ Florida families

FIRST TIME HOME BUYERS IN ALL OF FLORIDA

Buying your first home can be an exciting time for you and could signal some new personal changes as well. However, making a large investment can feel overwhelming and scary. One of the best ways to alleviate some of the stress is to do your research and to have the right home loan lenders by your side the whole way. Before you get started today, reach out to one of our lending experts and have peace of mind that you are working with the best. We work in your area – Miami-Dade, Broward, Palm Beach Counties and other parts of Florida too.

For First Time Home Buyers

Understand Your Mortgage & Define Your Budget

Which Type of Home Loan Should I Get?

Home Mortgages: What You Need to Know About Buying a Home

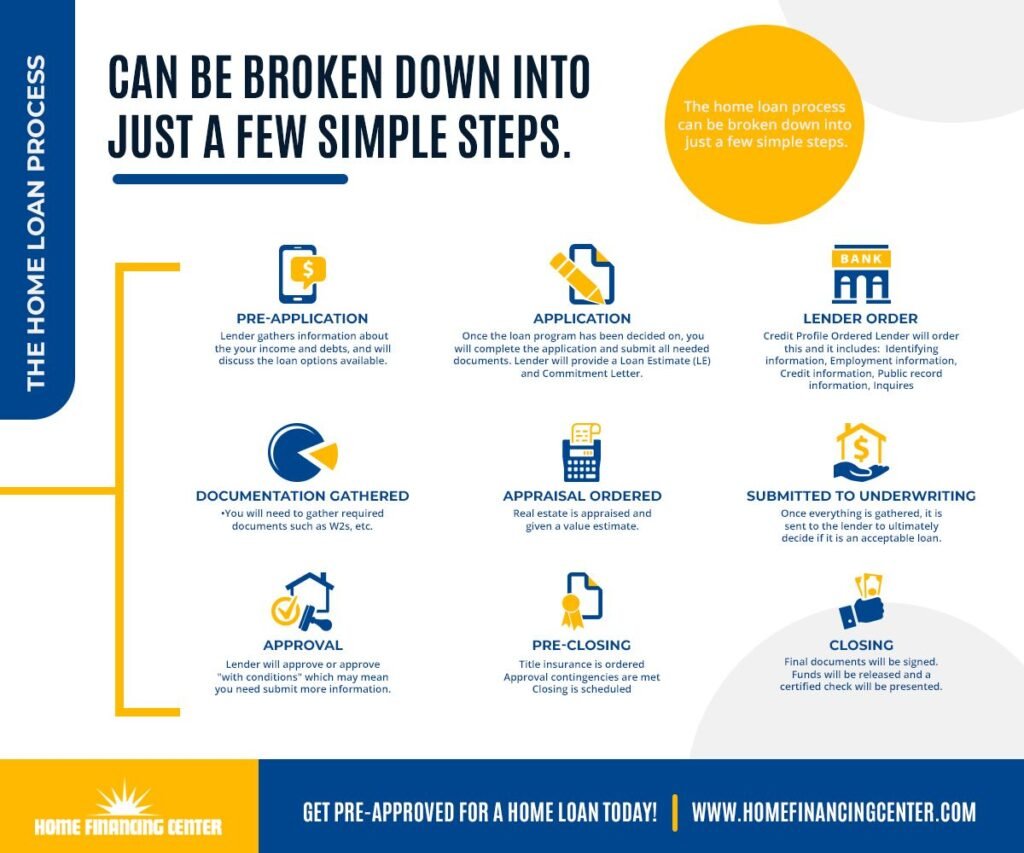

Looking at homes on real estate websites can be exciting, but has to be balanced with a realistic look at your budget and an understanding of the home loan process. Acquiring a home loan can be broken down into three basic steps:

Step 1: Understand Your Financial Situation & Needs

Your income, monthly budget, as well as personal credit, debts, and other aspects of your finances should be considered when you are creating your own budget for a home as well as what type of loans are right for you. There are quite a few options available for first time home buyers that can make buying your first home easier.

Step 2: Gather Needed Paperwork

After you have investigated the loans that you feel are best for you, you can begin gathering all the needed paperwork and information to fill out the application. Once you have everything you need you can apply for your loan.

Step 3: Approval!

Once your home loan has been approved by our lenders, and all parties have closed on it, you can begin searching for your first home!

Which Type of Home Loan Should I Get?

The type of loan that you need to purchase your first home depends on your situation and so will differ from person-to-person. Also, as a first-time home buyer, you have lots of options. A mortgage lender at Home Financing Center would love to help you find the loan that would help you buy the house you want. Below are some loans and home buying assistance programs that many first-time home buyers can take advantage of:

FHA loan

VA loan

USDA loan

Fannie and Freddie

State First-Time Buyer Program

Home Renovation Loan

Good Neighbor Next Door Loan

Dollar Homes

Fixed Rate Mortgages

Adjustable-Rate Mortgages

Jumbo Loans

Employer Assisted Housing

Affordable/Workforce Housing

Loans for Foreign Nationals

Types of Loans

Looking at homes on real estate websites can be exciting, but has to be balanced with a realistic look at your budget and an understanding of the home loan process. Acquiring a home loan can be broken down into three basic steps:

Learn more about home loans and finding the right type of mortgage for you. However, don’t do it alone! Schedule an appointment with one of Home Financing Center’s home lenders. We would love to help you find the right loan for you, navigate the loan process, and ultimately, find lasting financial security. Schedule an appointment with us!

Florida Home Assistance Programs

- HUD-Approved Housing Counseling Agencies

- Florida Association for Community Action

- Florida Housing Finance Corporation

- Habitat For Humanity

- HUD’s Community Development Block Grants

- HUD’s HOME Investment Partnership Program

- State Housing Initiative Partnership (Ship) Program

- USDA Rural Housing Service

Florida Home Assistance Programs

- Miami-Dade County OCED

- Miami-Dade Housing Agency

- Housing Finance Authority of Miami Dade County

- City of Hialeah

- Florida City (Call 305-242-0861)

- Homestead

- City of Miami

- City of Miami Beach (Call 305-673-7260)

- Miami Beach Community Development Corporation

- City of Miami Gardens

- Centro Campesino Farm Worker Center, Inc.

- Neighborhood Housing Services

- City of North Miami

What Our Clients Say

4.9/5 from 1,200+ reviews

Don't just take our word for it - hear from satisfied homeowners across Florida.

Home Loan Frequently Asked Questions

Find answers to common questions about our services.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has an interest rate that remains the same throughout the life of the loan. An adjustable-rate mortgage (ARM) has an interest rate that can change over time, usually in response to interest rate fluctuations in the market.

What factors determine the interest rate on a home mortgage?

The interest rate on a home mortgage is determined by several factors, including the loan-to-value ratio, the borrower’s credit score, the loan term, and the type of loan.

How much money do I need for a down payment?

The amount of money you need for a down payment depends on the type of loan you are getting and the lender’s requirements. Generally, you should expect to put down at least 3–5% of the purchase price of the home.

What are closing costs?

Closing costs are fees associated with the purchase of a home that are paid at closing. These fees can include loan origination fees, appraisal fees, title fees, and more.

What documents are required when applying for a home mortgage?

When applying for a home mortgage, you will typically need to provide the lender with your financial information and documents, such as pay stubs, bank statements, and tax returns. You may also need to provide proof of employment and proof of assets.