Trusted by 10,000+ Florida families

FHA Loans: Affordable Homeownership in Florida

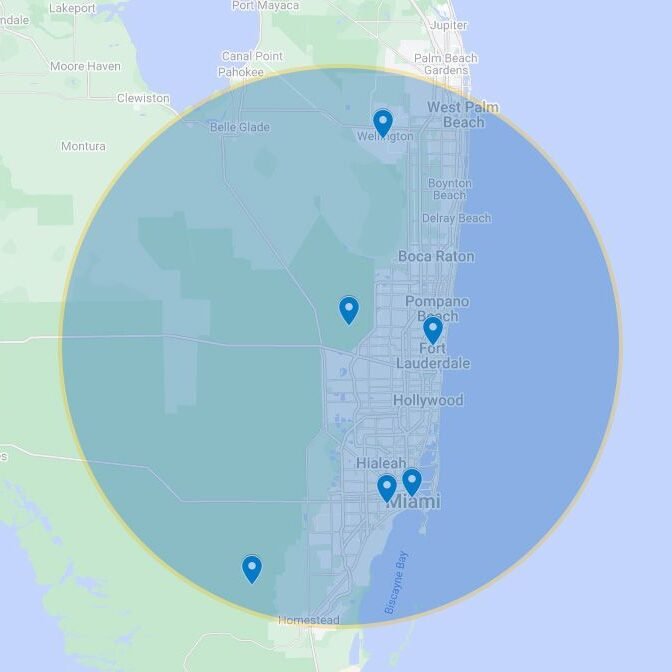

At Home Financing Center, we are proud to be your trusted partner in finding affordable housing and workforce solutions across South Florida. From Fort Lauderdale and Broward County to Miami, Coral Gables, Miami-Dade County, and Palm Beach County, we diligently work with both businesses and employees to find housing options that are convenient and advantageous for all parties.

Affordable Housing Solutions for Businesses and Employees

FHA loans are government-insured mortgages designed to make homeownership more attainable, especially for first-time homebuyers or those with less-than-perfect credit.

Employee Benefits

Customized workforce housing to meet employees' needs, enhancing productivity and reducing turnover rates

Affordable Housing Mission

Providing accessible and cost- effective housing options for businesses and employees in Florida.

Expert Assistance

Experienced professionals offering tailored advice, competitive rates, and flexible loan options.

Whether you want to lower your interest rate, monthly payments, or loan term, a home financing firm like Home Financing Center, can help you.

Employer-Provided Housing Solutions

We specialize in providing clients with a wide range of housing solutions tailored to the needs of the South Florida market. This includes everything from purchasing a single-family home to leasing an apartment. Our strong network is closely tied to federal housing and mortgage agencies, including FHA, VA, and Fannie Mae, to provide affordable housing options for your workforce throughout Florida.

Additionally, we offer commercial and investment property financing, including multifamily and mixed-use properties, ideal for business growth in South Florida. With our extensive network of lenders and investors, we can find the right loan for any situation.

Low Down Payment

Qualify with as little as 3.5% down, making it easier to save for your home.

Flexible Credit Requirements

FHA loans are more forgiving of past credit issues compared to conventional loans.

Competitive Interest Rates

Often offer attractive interest rates, which can lead to lower monthly payments.

Easier Qualification

Debt-to-income ratios can be higher than with conventional loans, providing more flexibility.

Assumable Mortgages

FHA loans are assumable, meaning a future buyer could take over your mortgage under certain conditions

Why Work With Us in South Florida?

Furthermore, when you partner with us, you can expect:

Experienced professionals

Knowledgeable in all areas of housing and mortgages from one of the biggest mortgage companies in the area.

Competitive rates and flexible loan options

Even amidst economic challenges.

Quick and easy application process

With no hidden fees.

Comprehensive advice and assistance

To help you find the best deal.

Our Mission: Providing Affordable Housing to South Florida's Workforce

At Home Financing Center, our mission is to provide affordable housing solutions to businesses and employees throughout the state of Florida. We strive to make housing more accessible and cost-effective, while ensuring that both businesses and employees benefit from our services. We believe that housing should not be a barrier to success, and our goal is to ensure that everyone has access to quality and affordable housing in communities like Coral Gables, Miami, and Fort Lauderdale.

We are committed to finding the best deals for our clients and helping them navigate the legal and financial aspects of owning or leasing a property. Contact us today for more information on our services and how we can help you and your business.

With more than three decades of hard work and experience in the mortgage sector, Home Financing Center has been able to provide affordable and workforce housing services to business owners and their employees in Broward County, Miami-Dade County, Palm Beach County, and beyond. By helping companies provide convenient housing for their employees, we improve life for both parties. Whether you’re a business owner or an employee, get in touch to learn more about the workforce housing advantages we can offer you!

What Our Clients Say

4.9/5 from 1,200+ reviews

Don't just take our word for it - hear from satisfied homeowners across Florida.

Affordable Frequently Asked Questions

Find answers to common questions about our services.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has an interest rate that remains the same throughout the life of the loan. An adjustable-rate mortgage (ARM) has an interest rate that can change over time, usually in response to interest rate fluctuations in the market.

What factors determine the interest rate on a home mortgage?

The interest rate on a home mortgage is determined by several factors, including the loan-to-value ratio, the borrower’s credit score, the loan term, and the type of loan.

How much money do I need for a down payment?

The amount of money you need for a down payment depends on the type of loan you are getting and the lender’s requirements. Generally, you should expect to put down at least 3–5% of the purchase price of the home.

What are closing costs?

Closing costs are fees associated with the purchase of a home that are paid at closing. These fees can include loan origination fees, appraisal fees, title fees, and more.

What documents are required when applying for a home mortgage?

When applying for a home mortgage, you will typically need to provide the lender with your financial information and documents, such as pay stubs, bank statements, and tax returns. You may also need to provide proof of employment and proof of assets.