Trusted by 10,000+ Florida families

Jumbo Mortgage Loans in Florida

At Home Financing Center, we’re proud to be a leading mortgage lender in Florida, connecting individuals and families with the perfect mortgage options for their needs. If you’re in the market for a home that exceeds the traditional loan limits, a jumbo loan could be the ideal financial solution to turn your real estate dreams into a reality.

What Is a Jumbo Loan?

In the realm of mortgages, a jumbo loan stands out as a financing option that surpasses the conforming loan limits established by major housing entities such as Fannie Mae and Freddie Mac. Specifically in Florida, where real estate prices can soar, jumbo loans empower prospective buyers to secure funding for high-value properties that may fall outside the scope of conventional loan limits.

Benefits of Jumbo Loans

Opting for a jumbo loan opens up a realm of benefits for the discerning homebuyer. This type of loan not only offers competitive interest rates but also provides the financial leeway to borrow substantial amounts, making it the preferred choice for individuals seeking to invest in luxury homes, upscale condominiums, or properties in sought-after neighborhoods across Florida.

How To Qualify for a Jumbo Loan

Qualifying for a jumbo loan typically necessitates meeting certain criteria, including showcasing a strong credit score, maintaining a low debt-to-income ratio, and being prepared to submit a larger down payment. Our seasoned loan officers at Home Financing Center are well-versed in navigating the complexities of jumbo loans and stand ready to assist you in securing a loan that aligns perfectly with your unique financial profile and housing aspirations.

Florida's Trusted Jumbo Loan Experts

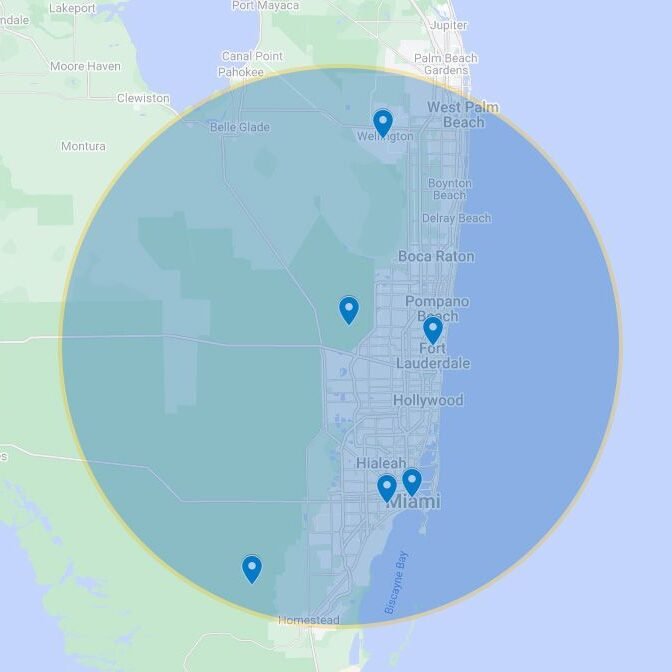

Look no further than Home Financing Center for a dedicated team of jumbo loan experts committed to serving the diverse mortgage needs of Florida residents. Drawing on our extensive market knowledge and wealth of experience, we take pride in guiding our clients through the jumbo loan process with professionalism, transparency, and personalized attention that sets us apart in the industry.

What Our Clients Say

4.9/5 from 1,200+ reviews

Don't just take our word for it - hear from satisfied homeowners across Florida.

Loan Frequently Asked Questions

Find answers to common questions about our services.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has an interest rate that remains the same throughout the life of the loan. An adjustable-rate mortgage (ARM) has an interest rate that can change over time, usually in response to interest rate fluctuations in the market.

What factors determine the interest rate on a home mortgage?

The interest rate on a home mortgage is determined by several factors, including the loan-to-value ratio, the borrower’s credit score, the loan term, and the type of loan.

How much money do I need for a down payment?

The amount of money you need for a down payment depends on the type of loan you are getting and the lender’s requirements. Generally, you should expect to put down at least 3–5% of the purchase price of the home.

What are closing costs?

Closing costs are fees associated with the purchase of a home that are paid at closing. These fees can include loan origination fees, appraisal fees, title fees, and more.

What documents are required when applying for a home mortgage?

When applying for a home mortgage, you will typically need to provide the lender with your financial information and documents, such as pay stubs, bank statements, and tax returns. You may also need to provide proof of employment and proof of assets.