Trusted by 10,000+ Florida families

Fixed-Rate Home Loan

When it comes to securing your future, one size doesn’t fit all. To secure your home and your dreams for the future, you need a loan that works for you! The experts at Home Financing Center know how to provide you the loan that is just right for you and your financial situation. They can not only offer you the best loans for you but can explain exactly why those financial products will best work for you. We want you to have peace of mind every step of the way. Work with Miami’s and Coral Gables’ Top Rated Local® Financing that services all of Florida!

Benefits of Finding the Right Loan With Us:

Top-rated mortgage company founded on trust

You always work with local representatives

We can work with you to find the most advantageous mortgage

Whether you want to lower your interest rate, monthly payments, or loan term, a home financing firm like Home Financing Center, can help you.

Choose the Right Mortgage For You

When it comes to securing your future, one size doesn’t fit all. To secure your home and your dreams for the future, you need a loan that works for you! The experts at Home Financing Center know how to provide you the loan that is just right for you and your financial situation. They can not only offer you the best loans for you but can explain exactly why those financial products will best work for you. We want you to have peace of mind every step of the way. Work with Miami’s and Coral Gables’ Top Rated Local® Financing!

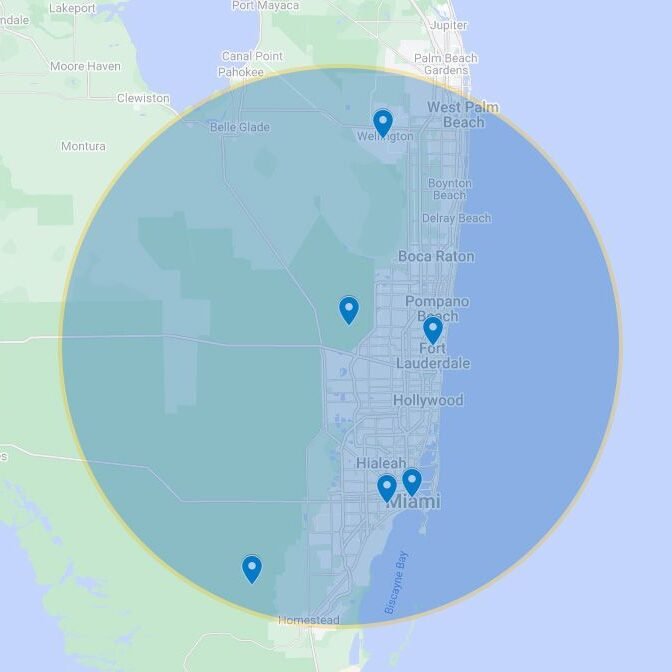

As South Florida’s largest independent mortgage banker, Home Financing Center offers a full range of financial tools you can use to purchase a home or property in Coral Gables, Miami, and beyond. Our fixed- and adjustable-rate loans are particularly effective, paving the way for clients to finally take possession of their dream homes. If you’re ready to get started, we’d love to hear from you!

Top-rated mortgage company founded on trust

You always work with local representatives

We can work with you to find the most advantageous mortgage

We Never Offer One-Size-Fits-All Home Loans

When it comes to choosing a mortgage, it’s important to sit down and talk with us about your needs, hopes, and financial situation. Depending on many different factors, one type of mortgage may be better for you than the others. For instance, a fixed-rate mortgage’s interest rate is determined when the home loan is originated, and it doesn’t change. The rate on an adjustable-rate mortgage will probably be lower, but it can change at any time. Only a clear view of the future and an understanding of your financial situation can help you decide which mortgage is best for you, and we want to help.

What Our Clients Say

4.9/5 from 1,200+ reviews

Don't just take our word for it - hear from satisfied homeowners across Florida.

Home Loan Frequently Asked Questions

Find answers to common questions about our services.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has an interest rate that remains the same throughout the life of the loan. An adjustable-rate mortgage (ARM) has an interest rate that can change over time, usually in response to interest rate fluctuations in the market.

What factors determine the interest rate on a home mortgage?

The interest rate on a home mortgage is determined by several factors, including the loan-to-value ratio, the borrower’s credit score, the loan term, and the type of loan.

How much money do I need for a down payment?

The amount of money you need for a down payment depends on the type of loan you are getting and the lender’s requirements. Generally, you should expect to put down at least 3–5% of the purchase price of the home.

What are closing costs?

Closing costs are fees associated with the purchase of a home that are paid at closing. These fees can include loan origination fees, appraisal fees, title fees, and more.

What documents are required when applying for a home mortgage?

When applying for a home mortgage, you will typically need to provide the lender with your financial information and documents, such as pay stubs, bank statements, and tax returns. You may also need to provide proof of employment and proof of assets.