Trusted by 10,000+ Florida families

Conventional Mortgage Loans

Navigating the world of home financing can be complex, but with Home Financing Center by your side, owning your dream home becomes a reality. Learn more about conventional mortgage loans and how our expert team in Florida can guide you through the process seamlessly.

Understanding Conventional Mortgage Loans

A conventional mortgage loan provides borrowers with unmatched flexibility, offering a range of options for primary residences, second homes, and investment properties. Home Financing Center specializes in connecting you with conventional financing solutions that align with your unique needs and financial goals.

Benefits of Choosing a Conventional Mortgage

Conventional financing through Home Financing Center grants you the freedom to select your loan term, repayment schedule, and interest rate preferences. Explore the advantages of fixed-rate and adjustable-rate mortgage options, tailored to optimize savings and financial stability.

Why Home Financing Center Stands Out

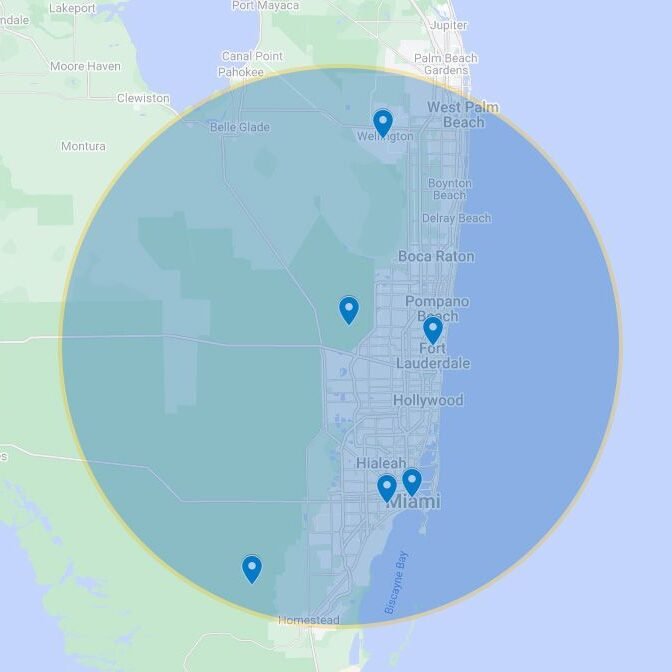

Home Financing Center is renowned for its competitive rates and flexible terms, empowering borrowers in the Florida area to secure financing for their homeownership goals. Our experienced loan officers are dedicated to providing personalized service, guiding clients to select the most suitable loan option for their specific circumstances.

Expert Guidance for Your Homeownership Journey

Whether you’re a first-time homebuyer or a seasoned real estate investor, a conventional mortgage loan from Home Financing Center offers the versatility needed to fulfill your homeownership dreams. Benefit from a diverse range of loan options, competitive rates, and unparalleled expertise, as we work tirelessly to make your homeownership aspirations a reality.

Our Commitment to You

At Home Financing Center, we understand the importance of providing excellent customer service. Our team of experts is available to answer any questions you may have and to help you navigate the home financing process. We are committed to providing you with the best possible mortgage experience and will work hard to get you the best possible rate and terms.

What Our Clients Say

4.9/5 from 1,200+ reviews

Don't just take our word for it - hear from satisfied homeowners across Florida.

Home Loan Frequently Asked Questions

Find answers to common questions about our services.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has an interest rate that remains the same throughout the life of the loan. An adjustable-rate mortgage (ARM) has an interest rate that can change over time, usually in response to interest rate fluctuations in the market.

What factors determine the interest rate on a home mortgage?

The interest rate on a home mortgage is determined by several factors, including the loan-to-value ratio, the borrower’s credit score, the loan term, and the type of loan.

How much money do I need for a down payment?

The amount of money you need for a down payment depends on the type of loan you are getting and the lender’s requirements. Generally, you should expect to put down at least 3–5% of the purchase price of the home.

What are closing costs?

Closing costs are fees associated with the purchase of a home that are paid at closing. These fees can include loan origination fees, appraisal fees, title fees, and more.

What documents are required when applying for a home mortgage?

When applying for a home mortgage, you will typically need to provide the lender with your financial information and documents, such as pay stubs, bank statements, and tax returns. You may also need to provide proof of employment and proof of assets.