Trusted by 10,000+ Florida families

VA Loans: Exclusive Benefits for Florida Veterans

VA loans offer unparalleled benefits for eligible service members, veterans, and surviving spouses, including no down payment and no private mortgage insurance.

Unmatched Advantages of VA Loans

VA loans are one of the most powerful benefits available to those who have served our nation. Home Financing Center is proud to help Florida’s military community leverage these unique advantages.

No Down Payment

For most eligible borrowers, a VA loan requires no down payment, making homeownership more accessible.

No Private Mortgage Insurance (PMI)

Unlike conventional loans with less than 20% down, VA loans do not require PMI, saving you significant monthly costs.

Competitive Interest Rates

VA loans often feature lower interest rates than conventional loans, leading to lower monthly payments.

Limited Closing Costs

The VA limits the closing costs lenders can charge, and some costs can even be paid by the seller.

No Prepayment Penalties

You can pay off your loan early without incurring any fees.

Assumable Loans

VA loans are assumable, which can be an attractive feature for future buyers.

Our team at Home Financing Center has deep expertise in VA loans and is dedicated to serving those who have served us.

Let us help you navigate your path to homeownership.

VA Loan Eligibility & Requirements

To qualify for a VA loan, you must meet specific service requirements set by the Department of Veterans Affairs. Once you have your Certificate of Eligibility (COE), Home Financing Center can help you with the rest.

Service Requirements

Eligibility depends on your service dates, length of service, and discharge type. Generally, 90 days of active service during wartime or 181 days during peacetime are required.

Certificate of Eligibility (COE)

This document confirms to the lender that you meet the VA's service requirements. We can help you obtain this.

Credit & Income

While the VA does not set a minimum credit score, lenders will have their own requirements. You must also demonstrate sufficient income to repay the loan.

Occupancy

The home must be your primary residence.

VA Funding Fee

A one-time fee paid to the VA, which can be financed into the loan. It is waived for veterans receiving VA disability compensation.

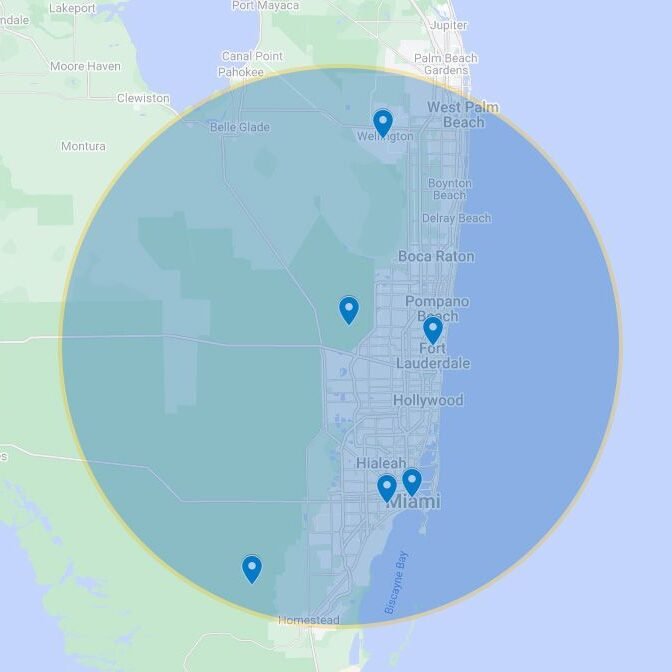

Why Work With Us in South Florida?

Furthermore, when you partner with us, you can expect:

Experienced professionals

Knowledgeable in all areas of housing and mortgages from one of the biggest mortgage companies in the area.

Competitive rates and flexible loan options

Even amidst economic challenges.

Quick and easy application process

With no hidden fees.

Comprehensive advice and assistance

To help you find the best deal.

What Our Clients Say

4.9/5 from 1,200+ reviews

Don't just take our word for it - hear from satisfied homeowners across Florida.

Frequently Asked Questions

Find answers to common questions about our services.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has an interest rate that remains the same throughout the life of the loan. An adjustable-rate mortgage (ARM) has an interest rate that can change over time, usually in response to interest rate fluctuations in the market.

What factors determine the interest rate on a home mortgage?

The interest rate on a home mortgage is determined by several factors, including the loan-to-value ratio, the borrower’s credit score, the loan term, and the type of loan.

How much money do I need for a down payment?

The amount of money you need for a down payment depends on the type of loan you are getting and the lender’s requirements. Generally, you should expect to put down at least 3–5% of the purchase price of the home.

What are closing costs?

Closing costs are fees associated with the purchase of a home that are paid at closing. These fees can include loan origination fees, appraisal fees, title fees, and more.

What documents are required when applying for a home mortgage?

When applying for a home mortgage, you will typically need to provide the lender with your financial information and documents, such as pay stubs, bank statements, and tax returns. You may also need to provide proof of employment and proof of assets.