Trusted by 10,000+ Florida families

Purchase Mortgage Loans for Florida Homebuyers

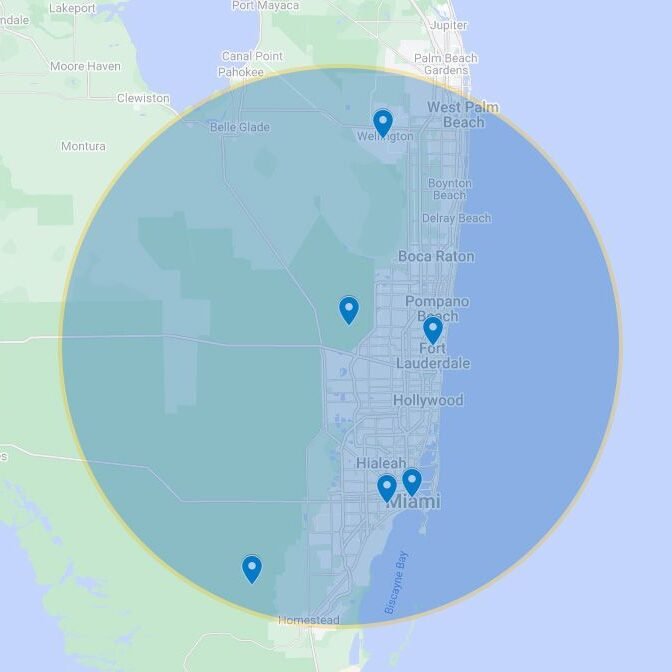

If you are interested in purchasing a home in Fort Lauderdale, FL, or the greater Broward County, FL, area, you may need help from a company that specializes in home loans. Many people are not able to purchase a home outright in cash. Therefore, most homeowners rely on mortgage loans to allow them to own a home.

Types of Mortgages for the South Florida Market

Navigating the world of mortgage options can feel overwhelming, especially if you’re a first-time homebuyer or new to the local market. At Home Financing Center, our team of knowledgeable professionals will guide you to find the perfect fit for your unique circumstances, tailored to the specifics of the South Florida real estate market. Depending on your situation, you could choose from any of the following mortgages:

Fixed-Rate Mortgages

Offer the stability of a consistent monthly payment, ideal for long-term budgeting in a region with dynamic property values.

Adjustable-Rate Mortgages (ARMs)

With rates that can change over time, suitable for those seeking lower initial payments or planning to move within a few years.

Jumbo Loans

Specifically designed to finance high-value properties, common in exclusive areas of Miami, Fort Lauderdale, and Palm Beach.

Loans for First-Time Buyers

Programs and assistance designed to facilitate home access in Florida.

Loans for Foreign Nationals

Specialized services for our diverse international clientele interested in investing in South Florida.

Refinancing Programs

To optimize your existing mortgage, whether to lower your interest rate, change the term, or access equity.

Reverse Mortgages

Offer liquidity to senior homeowners, allowing them to utilize their home equity.

Affordable/Workforce Housing

Options to support key communities in our region.

Commercial Loans

Financing for investment properties in Florida's thriving business environment.

Employer-Assisted Housing

Programs that may help you buy a home through your employer.

Whether you want to lower your interest rate, monthly payments, or loan term, a home financing firm like Home Financing Center, can help you.

Key Factors for Approval in Florida

Securing your mortgage involves not only choosing the right loan but also meeting the approval criteria. While some factors are out of your control, such as your monthly income, there are key actions you can take to significantly improve your chances of approval in South Florida’s competitive housing market:

For more information on our home mortgage loans, contact Home Financing Center by calling 305-777-1100 or 800-700-3000. We also serve those in West Palm Beach, FL, and the Palm Beach County, FL, area. We look forward to answering any questions you have about this process.

Improve your credit score

A strong credit history is crucial.

Save for a down payment

Generally, aiming for at least 3,5% of the purchase price is a good starting point, though this can vary based on loan type and lender requirements.

Pay off monthly debt

Reducing your debt obligations can positively impact your debt-to-income ratio.

Employment History

Lenders look for a history of consistent employment

Loan to value ratio

The price of the home is compared to how much it's worth

Why Choose Home Financing Center for Your South Florida Home Mortgage Needs?

When you work with Home Financing Center, you can expect:

A team with nearly 40 years of experience

Bringing deep knowledge of the Florida mortgage market.

A local women-owned business

Committed to the South Florida community.

A dedicated loan officer

Who will guide you every step of the way to buy your dream home.

The best rates in the marketplace

We work hard to offer you the most competitive terms available in South Florida.

What Our Clients Say

4.9/5 from 1,200+ reviews

Don't just take our word for it - hear from satisfied homeowners across Florida.

Home Loan Frequently Asked Questions

Find answers to common questions about our services.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has an interest rate that remains the same throughout the life of the loan. An adjustable-rate mortgage (ARM) has an interest rate that can change over time, usually in response to interest rate fluctuations in the market.

What factors determine the interest rate on a home mortgage?

The interest rate on a home mortgage is determined by several factors, including the loan-to-value ratio, the borrower’s credit score, the loan term, and the type of loan.

How much money do I need for a down payment?

The amount of money you need for a down payment depends on the type of loan you are getting and the lender’s requirements. Generally, you should expect to put down at least 3–5% of the purchase price of the home.

What are closing costs?

Closing costs are fees associated with the purchase of a home that are paid at closing. These fees can include loan origination fees, appraisal fees, title fees, and more.

What documents are required when applying for a home mortgage?

When applying for a home mortgage, you will typically need to provide the lender with your financial information and documents, such as pay stubs, bank statements, and tax returns. You may also need to provide proof of employment and proof of assets.